The good news is that winter is half over. The bad news is that winter is only half over. Don’t leave heating to chance. Instead think “furnace maintenance” — an ounce of prevention beats a pound of cure, and a chilly wait for an expensive repairman. Here are a few things that’ll help. First change the filter. During heating season, do this monthly and — to save money — don’t buy them one at a time. Buy a whole case, and save money two ways — on the price and on your energy bills. A furnace heats more efficiently and runs less with clean filters that are changed often. Other mid-winter furnace tips? Check your owner’s manual for proper guidance. Turn off the power, vacuum the blower compartment, check tension and condition of the blower fan belt and lubricate fan-motor oil ports with a few drops of lightweight electric motor oil (do not over-oil or use automotive oil — both practices are bad). A little mid-winter furnace maintenance gives a lot of peace of mind.

Home Maintenance Tasks You Need to Tackle in January

By Lisa Gordon

We’re not gonna lie: Taking care of home maintenance tasks isn’t going to be any easier in January than it was during the holiday bustle of December. You’ve buttoned up the house against the cold, and you’re in the dead of winter without even a glimpse of spring in sight.

Still, homes must be maintained, even in January. Why? It’s always easier and cheaper to maintain a house than to repair it—sometimes to the tune of thousands of dollars.

Since we’re all about saving you time and money, we’ve created a handy checklist of home maintenance tasks that need to be completed this month—plus tips for how to do them faster and easier, or with the help of a pro. So take a deep breath and dive into those chores. The good news? Many are inside chores, so you have no “It’s too cold!” excuses.

1. Handle holiday cleanup

Task: You’ve had the fun, and now it’s time to get rid of the evidence. Take down holiday lights and wrap them around a hanger to prevent tangling; set the oven on self-clean, then wipe the interior with a vinegar-soaked cloth; chip your Christmas tree and throw it in the compost pile, or scatter it around garden beds and shrubs for a midwinter mulching.

Shortcut: Instead of pitching holiday cards or tucking them away never to be seen again, recycle them into gift tags for next year. Find a pretty part of the card that has no writing on the back, cut it into a small square, and punch a hole in the corner.

Call in the pros: If you’ve ever considered a cleaning crew, now’s the time. Figure on paying $200 to $300 for a one-time cleaning. Ask friends who have a regular cleaning person to share the name for a one-off.

2. Protect the pipes

Task: Prevent exposed pipes from freezing as temperatures drop. A frozen pipe can crack or burst, flooding your home. If you’re planning a winter vacation, don’t forget to wrap pipes with heat tape you can control with a thermostat. And if you haven’t turned off water to outdoor spigots yet, consider yourself lucky—if they haven’t yet burst, shut off water valves and open spigots to drain existing water.

Shortcut: To thaw a frozen pipe, wrap it with a heating pad or turn a hairdryer on it.

Call in the pros: If a pipe bursts, shut off the main water valve to your home and call a plumber, which will run you anywhere from $45 to $150 an hour. If everything’s drenched, a water remediation or restoration company can perform cleanup —cart away damaged material, replace ceilings and walls, paint, and reinstall plumbing fixtures—for $23 a square foot.

3. Check for storm damage

Task: After winter storms, inspect your home’s roof, siding, gutters, and yard for wind, snow, or ice damage.

Shortcut: Instead of climbing on the roof to look for missing shingles, use binoculars to search for damage. Better yet, buy a drone that can fly over your house and spot damaged areas.

Call in the pros: A little storm damage can become a big problem if you don’t make immediate repairs. A roofing company can inspect and replace a few shingles for $95 to $127; a handyman can reattach hanging gutters for $171 to $492; and an arborist can remove cracked tree limbs and prune trees for $375 to $525.

4. Seek and destroy hidden dirt

Task: Clean those filthy places that people don’t see but you know are there. They include the range hood and grilles, refrigerator coils, tops of ceiling fans, dusty light fixtures and bulbs (make sure lights are off before dusting), and HVAC vents.

Shortcut: Let your dishwasher clean metal parts such as vent grilles and range hood filters. You can pop dirty sponges and dishrags in the dishwasher, too.

Call in the pros: This deep cleaning is above and beyond the tasks that cleaning crews normally perform. If you want a crew to do this type of cleaning, negotiate the surcharge up front.

5. Give hardware some love

A lot of hands probably touched that door handle, so go head and wipe it down.

wakila/iStock

Task: Shine and tighten doorknobs and hinges; tighten loose cabinet pulls and nobs; and level cabinet doors.

Shortcut: To clean metal hardware, wash with soapy water, then shine with a microfiber cloth dipped in vinegar or lemon juice. Brass polish will remove tarnish from solid brass hardware. Not sure it’s brass? If a magnet sticks, it’s most likely metal, not solid brass.

Call in the pros: If you’re going to take off hinges and locks, hire a handyman (those doors are heavy). Prices vary widely, and some handyman services charge $125 an hour for skilled jobs. Cleaning hardware is more tedious than skillful, so don’t pay more than $30 to $60 an hour.

6. Do a deep declutter

Task: Banish piles, clean out closets and drawers, and tackle the basement if you can stand it. Channel your inner Marie Kondo: If you haven’t touched something in a year or don’t love it, then you should toss, donate, or recycle it.

Shortcut: If you can’t face a total house declutter, do little bits over a few days. Pick one room or a corner of the room to organize. Or, every time you walk into a room, put/throw one thing away.

Call in the pros: Professional organizers take no prisoners when decluttering your home and setting up systems to keep things nice and tidy. But this tough love doesn’t come cheap. A professional organizer costs $30 to $80 an hour, and the average room takes 8 to 12 hours to organize.

7. Think green

Task: If you can’t deal with the January gloom, you can always look ahead to spring. Grab those seed, bulb, and bare-root plant catalogs, and start planning your flower and vegetable gardens. If you’re starting seeds inside, plant them about six weeks before the last frost in your area.

Shortcut: You’d be amazed by how much produce you can grow in raised-bed or container gardens. There’s no hoeing, raking, or digging. Create your own weed-free soil by mixing one-third vermiculite, one-third peat moss, and one-third varied compost.

Call in the pros: What, and miss all the fun? A professional landscape designer, who designs gardens and suggest plants, costs $50 to $100 an hour. Some garden centers will give you free design advice if you buy plants there. Also, seed catalogs often have free garden plans.

More homes were sold in Wisconsin in 2015

Madison, WI – More homes were sold in Wisconsin in 2015 than any year since 2005 according to the year-end analysis of the existing home market just released by the Wisconsin REALTORS® Association (WRA). A total of 76,693 homes sold in the state last year, up 11.4 percent over 2014, and median prices were 5.1 percent higher in 2015 compared to 2014. Strong December home sales helped boost the annual sales figures, with the final month of the year up 8.9 percent over December 2014 and median prices were up 3.7 percent to $149,900 over that same period.

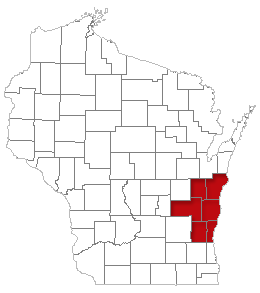

“It has been a phenomenal year for housing, with more than 7800 additional homes sold this year compared to last year,” said K.C. Maurer, Chairman of the WRA Board of Directors. “This is the best market we’ve seen in more than 10 years,” Maurer said. The 76,693 homes that closed in 2015 topped the 68,857 sold last year, just shy of the 78,125 sold in the pre-recession year 2005. “The strength of this market was seen across the entire state, with sales up by double-digit margins in every region,” Maurer said. The six regions in the state saw home sales grow at between 10.3 percent and 12.5 percent in 2015 compared to 2014.

“We would have sold more homes had we not been constrained by very tight inventory levels, ”said Michael Theo, President and CEO of WRA. State inventories of unsold homes fell to just over 40,000 in December, and while inventories typically do fall during the winter months, the monthly average for 2015 was just over 47,900. This is well below the 2010 monthly average of about 66,000 unsold homes.

“Part of the reason housing supply has declined is that foreclosures have fallen to levels not seen since the early part of the last decade,” said Theo. In 2015, the state recorded 10,700 foreclosures, which is similar to the average of 10,816 between 2002 and 2005. By comparison, during the depth of the recession, there were approximately 28,500 foreclosures in both 2009 and 2010. “We are clearly back to stable pre-recession levels which is good,” he said.

“The combination of strong housing demand and tight inventories have both pushed median prices up in 2015,”said Theo. He noted median prices rose 5.1 percent to $155,500 for all of 2015 compared to 2014. “This is well above the rate of inflation, which has been near zero for most of 2015,” he said. The 2015 inflation rate has not yet been released, but the annual pace of inflation derived from the monthly Consumer Price Index has ranged between -0.2 percent and 0.5 percent through November of 2015. “Not many assets have maintained their value in 2015 like housing,” said Theo. Despite these increases, Wisconsin’s housing remains very affordable according to the REALTORS’ report.

The Wisconsin Housing Affordability Index measures that portion of the median priced home that a buyer with median family income can afford to buy, assuming 20 percent down and a 30 year fixed rate mortgage financed at current rates. The index stood at 236 in December and has averaged 233 for all of 2015, which is virtually unchanged from the previous year figures.” Even though our prices have been rising at a healthy pace, low interest rates and modest improvements in estimated family income have kept affordability high,” said Theo. The interest rate on a 30 year mortgage was below 4 percent for all but one month in 2015. “Eventually we expect some inflation and that will ultimately drive mortgage rates upward which will likely reduce our affordability,” he said. Still, the fundamentals for this market are solid with a growing state economy, low interest rates and housing that remains affordable for our buyers. “Experienced REALTORS® know their local markets and can help buyers find the best in this tight housing environment,” said Theo.

Source: www.wra.org

Housing Market Update

New-home construction in the U.S. climbed in June to the second-highest level since November 2007 as builders stepped up work on apartment projects.

Housing starts rose 9.8 percent to a 1.17 million annualized rate from a revised 1.07 million in May that was stronger than previously estimated, figures from the Commerce Department showed Friday in Washington. The median estimate of economists surveyed by Bloomberg was a 1.11 million rate. Ground-breaking on multifamily dwellings jumped 29.4 percent.

Building permits for single and multifamily properties, a gauge of future construction, climbed to an almost eight-year high, the report showed. Steady job gains, low mortgage rates and a gradual easing of lending standards are propelling sales, indicating housing will become a bigger source of strength for the economy.

“They’re pretty positive numbers,” said Lewis Alexander, chief economist at Nomura Securities International Inc. in New York. “You’ve got decent employment growth that’s been particularly good for young people, you’ve got relatively low interest rates, somewhat easing of credit standard — all of those things are helping.”

Estimates for housing starts in the Bloomberg survey of 76 economists ranged from 1.03 million to 1.23 million. The May figure was revised up from 1.04 million.

The gain in starts of multifamily homes followed a 16.9 percent decrease the previous month and a 37.5 percent April surge. Data on these projects, which have led housing starts in recent years, can be volatile.

Single-Family Homes

Starts of single-family houses eased to a 685,000 rate from 691,000 a month earlier, the report showed.

Three of four regions had a decrease in single-family construction in June, paced by a 27.3 percent drop in the Northeast and a 7.1 percent decline in West, according to the report.

Building permits increased 7.4 percent in June to a 1.34 million annualized rate, the highest since July 2007. They were projected to fall to 1.15 million.

Applications to begin work on single-family projects rose to 687,000 in June, the most since January 2008. Permits for construction of apartments and other multifamily dwellings rose 15.3 percent after a 20 percent jump the previous month.

Builder Confidence

The starts and permits data are consistent with a report Thursday that showed builders are increasingly confident in the outlook. The National Association of Home Builders/Wells Fargo said its sentiment gauge held July at the highest level since November 2005.

Builders and lenders alike are benefiting from an improving housing market.

“Housing activity has been especially encouraging with second quarter position to be the best quarter for home sales since 2007,” John Stumpf, chief executive officer at Wells Fargo Co., said on a July 14 earnings call. Employment opportunities and higher consumer confidence make “me optimistic that the economic expansion will sustain momentum into the second half of the year, and Wells Fargo should benefit from the increase in economic activity.”

A steadily strengthening job market “is perhaps the most important near-term driver for the homebuilding industry,” Bloomberg Intelligence analyst Drew Reading wrote in a July 10 research note. Even though average monthly payroll gains have slowed this year to around 208,000, that “may continue to provide a boost to demand,” he said.

Young Adults

Job gains among young adults — those 25 to 34 years old — may also help propel sales of entry-level homes, Reading wrote, especially as they set off on their own to form households. That could improve the outlook of companies such as LGI Homes Inc., D.R. Horton Inc. and KB Home, which have the most exposure to the entry-level market.

Historically low borrowing costs, combined with rising rents, may also may home-buying more compelling. The average 30-year fixed-rate mortgage was 4.04 percent in the week ended July 9, compared to an average 9.4 percent in the 30 years leading up to the recession, according to data from Freddie Mac in McLean, Virginia.

June National Home Ownership Month

For many Americans, owning a home represents freedom, independence, and the American dream. During June the National Homeownership Month, we highlight the benefits of owning a home and encourage our fellow citizens to be responsible homeowners.

During National Homeownership Month and throughout the year, I encourage all to take advantage of financial education opportunities to explore home ownership. By practicing fiscal responsibility, We all can contribute to the strength of our neighborhoods and our cities.

Join me in recognizing the importance of homeownership and building a more prosperous future for themselves and their communities.